As harvest income becomes more certain we can start planning expenditures for 2023. Input costs are forecast to remain high and interest rates are rising, but after some careful budgeting there’s likely to be income left for discretionary spending. The following are things to consider when budgeting cashflow in 2023.

Financial Buffers as Cashflow

- Retaining some harvest funds in your trading account can create a cashflow buffer for next year (i.e. peak balance vs overdraft limit).

- Deferred term arrangements for input costs often incur a higher interest rate than bank overdrafts. Allocating some harvest funds to clear deferred arrangements and avoiding them next year can be beneficial.

- Debt repayment on term loans.

Possible benefits: lower interest costs, more flexibility with next year’s expenses, stronger equity.

Machinery Capital Purchases

- What is next on your 5 Year Replacement Schedule? Look at your major items and schedule replacement dates according to expected working life / replacement costs.

- Will the machinery upgrade improve productivity and/or efficiency?

- Will the upgrade make life easier, improve job satisfaction and workplace safety?

- Aim for an average of 10% of your farm income being spent on machinery capital and the principal portion of your machinery finance repayments.

Possible benefits: keep machinery current, production efficiency, lower repair costs (hopefully) and a happier and safer workplace.

Improvements

- Increase on-farm storage for harvest logistics and marketing

- Improve fencing and roads for all-weather access.

- Better working environment – upgrade shearing shed / workshop.

- Investment into soil health (gypsum, lime) or land sustainability (trees, erosion control).

Possible benefits: improve marketing opportunities, safety, happy workplace, environmental impact.

People

- House renovations, car upgrades, holidays.

- Fund a new employee.

- Employee bonuses, wage increases – what do we need to do to retain good workers?

Tax Planning

- Meet with your Accountant early in the year to understand your taxable income estimates.

- If it’s going to be a strong profit year, consider putting some cash into FMDs as a financial buffer.

- Make concessional contributions into Superannuation.

Possible benefits: financial buffers, retirement planning, assist with tax management.

Succession & Estate Planning

- Build off-farm investments.

- Early-payments to off-farm children as early inheritance to assist them when they need it.

- Transition some of the business or assets to the on-farm children

Next Step

Wise allocation of the profits in good years helps the business become stronger and more resilient in the future.

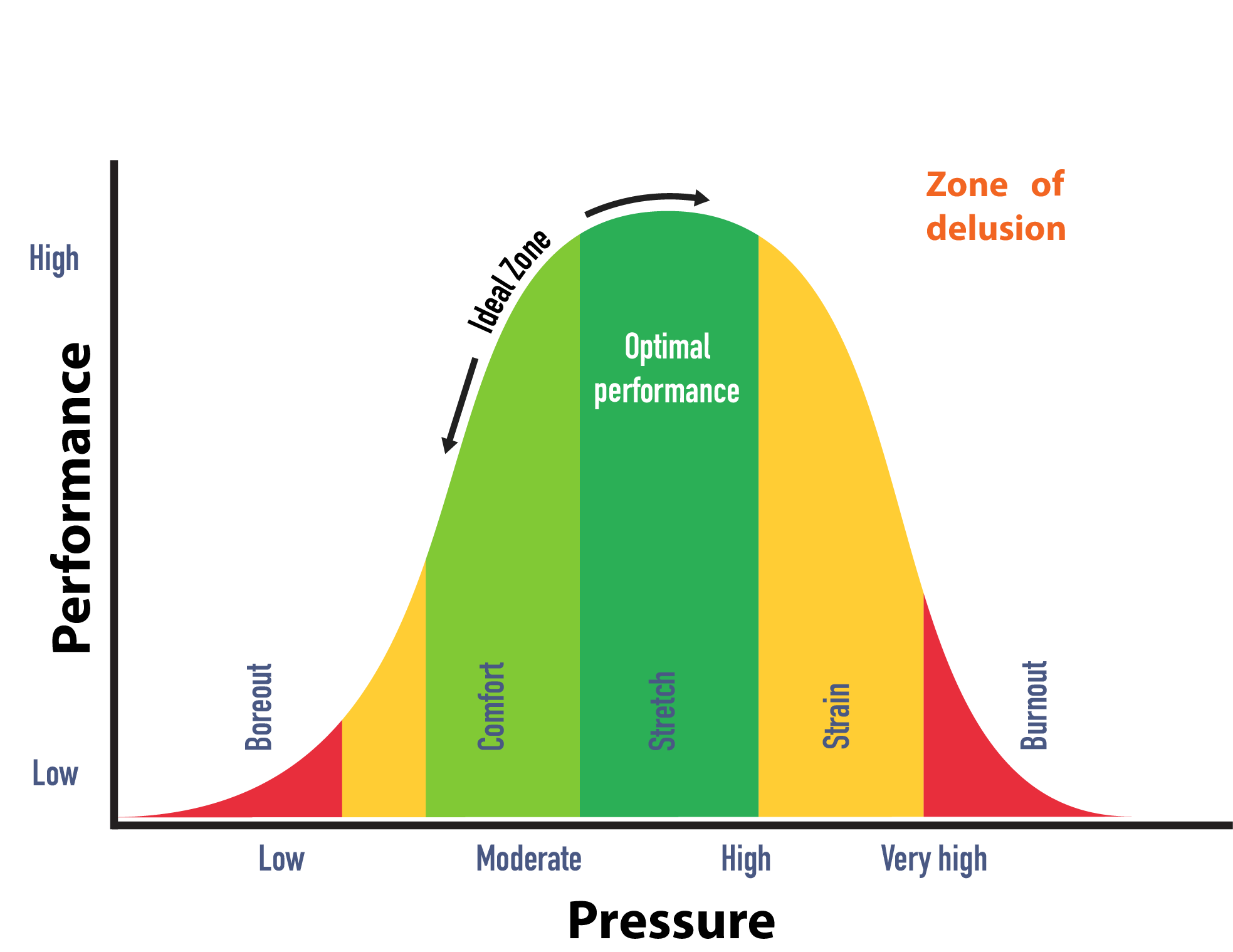

If harvest pressure is causing your stress bucket to be full, wait until you’re back in the Ideal Zone and talk it through with family or your advisor to ensure you’re meeting long-term goals and optimising potential for the coming year.

ORM can assist with budgeting and business planning. Good planning helps when reviewing options for the current year and assessing which will have the biggest impact on your business’s profitability and well-being.

Michele Potter, Finance Manager.

For more information contact us here admin@orm.com.au