A message from Phil

High Cost Paddocks and their profit risk.

Fertiliser markets – What is all the fuss about?

ORM brings International Guest to Bendigo

Update on happenings at ORM – Welcome Dan Duggan

A Message from Phil

The hay market must be HOT when a buyer offers you $25 per tonne more than your asking price, if you’ll sell them four loads instead of two!

And where are grain prices going? If I use the pricing at my local grain handler site, beans were $490/t at harvest, they’re now $710/t, a 45% rise in 8 weeks. Barley was $240/t at harvest it’s now $295/t a 23% rise. The interest cost on carrying the beans for 8 weeks is approx. $3.00 per tonne against a return of $220 per tonne – a no brainer to hold! But when do we sell? There’s plenty of market intelligence around to help inform our marketing decisions. However there’s a bit of crystal ball forecasting in any forward estimates.

Hold or Sell?

The trigger to sell grain or hay is often to meet cashflow needs. But should that be the case? A few years ago, when grain was worth half current prices. I presented business cases to a few banks asking them to extend the clients trading facilities. This was so that the client could hold grain for 12 months in anticipation of better prices. The attitude of the banks at that time, and currently, was that if holding grain required an increase in bank debt to finance cashflow, it had to be secured against strong equity in land. Otherwise bank’s were of the view that holding grain was speculating on markets and hence a financial gamble which they did not support.

We can assume the Banks position is based on sound advice from their specialist analysts and advisors. Hence we could conclude that carrying grain has financial risk, no matter how confident or informed our own marketing position is. However, making the decision to carry grain for a 23 to 45% return in 8 weeks is the best investment I’ve heard in a long time. So carrying grain and hay has been a good business decision for harvest 2019. But do we continue to carry to see what the market does? When do we pull the sell trigger? If we miss the top of the market by holding too long, can that be justified by the return already achieved?

I’m still riding the price wave, and hoping the crest is still a little way out there yet.

ORM does not provide advice on grain/hay pricing, there’s others that specialise in that area. The crystal ball relies on their knowledge and market intelligence.

Contact Us : with your feedback

What’s news?

- Client reviews with ORM are showing harvest 2019 income is 20 to 50% above budget. Extra income transfers to extra profits, so happy times!

- Remember the most important asset in your business is the people. Celebrate the good year by ticking off some of the goals you and your family have been working towards.

High Cost Paddocks

Identifying the high cost paddocks

High cost paddocks refer to paddocks with a known weed, pest or nutrition issue. They can be identified at annual planning time. Paddocks known to have the highest annual cost per hectare relative to their potential income, are the high cost paddocks.

The financial risk is greatest in the high cost paddocks

High costs paddocks present the greatest risk of financial loss in a low-income year. The low-income event could be due to a grain prices or an adverse seasonal event. Where production costs are high, relative to income, there is a limited ability to absorb production losses. A better financial outcome may be achieved by removing them from the crop sequence. This would reset the paddock in readiness for reintroduction into the crop sequence the following cropping season.

Some businesses will accept the outcome from high cost paddock/s. Its’viewed as part of an overall sequence of enterprises which is profitable in the medium term. This is justifiable however often the weakest link in the chain, the high cost paddock can cause a ‘leakage’ of profit over time.

Substantial shift in farm costs

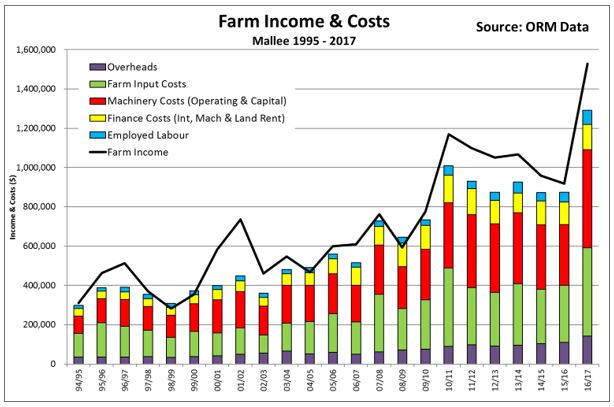

Since 1994, total annual operating costs per business in the Wimmera-Mallee farming systems have doubled, and in some cases tripled (Figure 1).

The increase in total costs per business is due to growth in scale (area farmed), intensification of cropping rotations and higher inputs. To manage problem weeds and maintain fertility in response to a more intensive cropping system, chemical and fertiliser use has increased.

Figure 1 – Farm Income & Costs Mallee 1995-2017. Source AgProfit

Seasonal volatility

Losses can result from an unexpected grain price drop, frost event, heat spike and/or an extended dry period. These events cause seasonal volatility of income and profitability.

Resilient farming systems are those that operate profitably in more years than not. Farming systems that achieve lower income volatility and lower total costs have more profit years. As a result, the potential for and impact of losses due to difficult seasons are reduced in frequency. Hence the risk of core debt increasing from these ‘loss’ years is less.

So how do we make our farming system more resilient?

The Farming System

Adopting the farming system that suits the environment and the characteristics of each business determines the potential profit.

The selection of enterprises and the frequency of re-occurrence of particular enterprises in the land use sequence over time are critical components of the profitability framework of a farming system. The appropriate farming system for each business depends on factors such as:

- Costs, including fixed and debt servicing

- Availability of resources (Machinery and labour can be provided by contractors)

- Management preference and skills

- Physical characteristics of the farm – soil type, topography and lay out

- Seasonal climate and weather patterns – rainfall reliability, frequency of extreme events such as frosts, heat spikes and wind

All of these factors will influence the risk profile of the farming system which is best suited.

Less can be best

If profit is frequently absorbed by high costs and income volatility. Then farming system that achieves the equivalent profit with lower costs per hectare and less fluctuation of income is preferable. Breakeven income is achieved when all costs are covered. In most seasons yield is correlated to rainfall. Therefore, if costs per hectare are lower, then the breakeven yield is also lower. This results in more years when a profit can be achieved. When rainfall is unreliable, a farming system with lower costs per hectare has potential to make profits in more years. More profit years contribute to stronger profitability and a more resilient farming system.

In Conclusion….

- Farm profit performance can be influenced by:

- Removing the high costs paddocks from the crop rotation.

- Reducing costs per crop hectare on the remaining cropped paddocks.

- Making profits in more years due to lower overall costs.

- Managing costs, reducing income volatility and achieving consistent profits (i.e. profit during most years). All contribute significantly to maximising the long-term operating returns and financial sustainability of the farm business.

Back to Top

Fertiliser Markets – What’s all the fuss about?

You’d have to have been hiding under a rock in recent months not to have been baled up by someone wanting to chat about the fertiliser market. Where it’s been, where it’s going and if it’s a good time to lock in some volume at current values.

With this in mind, we thought we would take some time to have a closer look at what’s influencing the fertiliser markets and look at the topic in a whole farm context. Hopefully arming you with some tools to rationalise these conversations and bring them back to what works for your enterprise specifically.

What is happening in the fertiliser market?

Great question, and the answer is as convoluted as most commodity market pricing mechanisms are.

But there are a few key points that we can focus on currently:

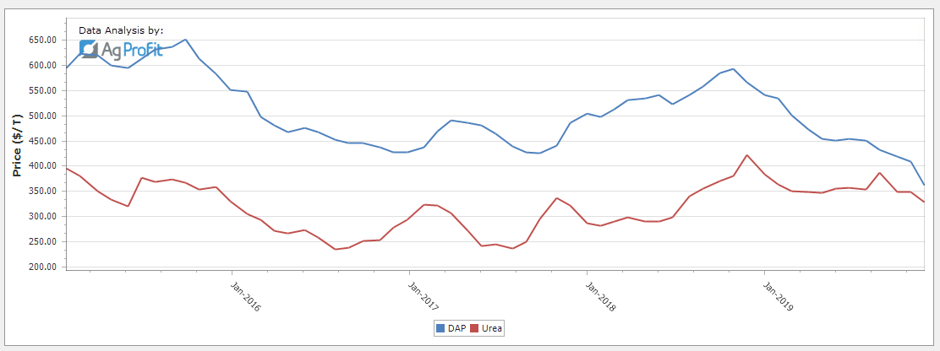

- Fertiliser markets ARE lower.

Fig 1 – DAP and UREA price per tonne Jan 2015 to Jan 2020. Source AgProfit

Currently we are seeing multi year lows across fertiliser products, which anecdotally looks to provide a great opportunity to reduce input costs accordingly. There are a few factors to consider in this though:

- It is always hard to split the talk from the reality in markets like these that have no real exchange. Transparency is limited and at times there appears to be a complete disconnect between offshore markets and local pricing.

- The main drivers of pricing are offshore values (as above in AUD terms). Driven by natural gas markets, global supply and demand, and currency exchange.

- As an importer of fertiliser products, our supply, vs demand vs timing quantum, can sometimes throw our local pricing relativities into overdrive, or flatline them.

- Domestically it is a supply and demand driven market in its truest from.

What should I consider for my business?

Each farm business needs to reflect on their own needs and situation. Before purchasing based on price alone, assess other variables that may provide a measure of value to the business.

- Start by looking at your historical use and cost of fertiliser. Measure this against the income for previous seasons.

- If you fall within a range of 12% or lower for fertiliser costs as a percentage of farm income. Then your input costs for fertiliser are being well managed.

- Use this same comparison on current pricing, overlain with your cropping plan for the coming season, budgeted use and forecast farm income.

- This comparison should help highlight, for your individual enterprise, the actual tangible benefit of current values in terms of input cost vs farm income as a relativity.

Price volatility ….. what to consider.

As with any commodity market, particularly one influenced by available tonnages and by local demand, volatility is always a risk. The current values are lower than previous years, the drought has no doubt exacerbated the offshore and international influences (which have also pushed markets lower), but there remains this volatility risk.

Locally some of these include a large rainfall event that stimulates any late summer cropping in the north. Or the east coast coming back into a more average rainfall cycle, stimulating more planting and therefore more demand. If this happens in a rush, and the timing of available tonnages does not line up, then the supply demand equation may tip.

In saying that, the opposite does hold true, and we know that the east coast has a long way to go before this scenario is likely to eventuate. If offshore values remain soggy then hopefully we see a solid reduction in a major input cost that translates into a much better return per ha for growers.

To conclude; fertiliser markets appear to provide a good opportunity at present to lock in a lower input cost for the coming season. However, prior to deciding on this based on price alone, it is important to look at your enterprise in its own right, decide where you fit, and what works for you.

As always, there remains risk of markets moving in either direction. This is why getting comfortable with your decision to lock pricing in based on a whole farm perspective is the key to making informed, relevant and profitable decisions for your enterprise.

The take home message here is ….

Whilst values are low when reflecting on the last 5 years or so. It is important to understand what the actual value to your own business represents. This may allow you to;

- Capitalise on lower pricing, and lock that in to bring you into a better benchmark cost vs income ratio. Alternately if you are already in a healthy range, it may allow you some flexibility in exploring potential further downside in markets, whilst knowing where your ceiling price is to maintain your current healthy ratios.

- Increase rates of other trace elements to build ongoing reserves, whilst also maintaining a healthy cost to income ratio. This is a good example in maintaining your benchmark expenditure targets, whilst investing in future yield potential.

Whilst there is a lot of talk around in this space, it is a good idea that each enterprise takes the further step of analysing these values relative to their whole farm enterprise. Rather than making a decision based on pricing in isolation.

Back to Top

International guest to be key note speaker at upcoming events.Image: Keith Norman from Stamford in Lincolnshire, U.K. |

|

One of the ORM Communications’ team most challenging but rewarding projects is the annual planning and delivery across Southern Australia of the GRDC Grains Research Updates. Since 2009 ORM has convened these grains industry flagship events. The team are as excited as ever about the February 2020 programs. The aim of the events is to inform and challenge grain growers and their advisors as we enter the third decade of the 21st century. ORM consultants have been in discussions with researchers, advisors, growers and the GRDC since June to define and refine the final programs.

Upcoming event – Bendigo, Victoria.

The Victorian event is the two-day Update held in Bendigo on February 25 & 26. The program boasts an in-depth analysis of a range of ‘farm ready’ research along with some big picture perspectives, including an international perspective. ORM has harnessed its extensive grains industry networks to engage Keith Norman. Keith is a highly respected farm consultant from Stamford in Lincolnshire, UK, who will provide insights into the production targets being met under the strict regulatory environment imposed in the UK. Keith is also a wealth of knowledge on pushing yields towards the theoretical maximum and the required agronomy in a high rainfall environment including nutrition and fungicide management.

The GRDC Research Update Bendigo program will also take a deep dive into new and emerging pre-emergent herbicide products. The focus will be how we will get the best value from these in our farming systems. Two well-known herbicide experts, Dr Chris Preston and Mark Congreve will lead these sessions. The best management of pastures in rotation with crops will be addressed by southern NSW based consultant, Tim Condon and Dr James Hunt from La Trobe University. Tim and James will scope out the potential to bust the big yield constraints facing the industry.

A diverse program will set the scene for the industry productivity and profitability talking points for 2020. To view the program and register for this and other events go to www.orm.com.au

Back to Top

Update on happenings at ORM

We welcome Dan Duggan to the ORM Team.

Dan’s a highly motivated, skilled individual who has a passion for the Ag Industry and brings a broad range of experience to ORM. He’s worked on livestock and cropping properties, as well as in soft commodity trading, marketing and risk management, into domestic and export markets. This combined with his oversight and execution of large-scale infrastructural projects and general management of large highly skilled teams, means he brings a diverse range of skills to the ORM team.

For the best part of 15 years Dan has worked in the grains industry providing growers with risk management advice and marketing options as well as trading grain, oilseeds and hay into domestic and export homes. He also previously worked in recruitment and the agricultural resourcing space, so he understands the challenges of finding the right person for the job.

When Dan’s not working you can generally find him with his growing family, in the garden or on the river sneaking in a fish.

With a diploma of Commerce majoring in Agribusiness a well as being PS146 Accredited in Managed Investments and Derivatives, Dan also possesses a range of industry specific qualifications including a Certificate in Grain Trading (Grain Trade Australia), Trade Rules and Dispute Resolution Accreditation, Grain Merchandising, Grain Quality Standards Certification, and Certificates in Financial Markets Technical Analysis.

ORM welcomes Dan who has recently moved back to central Victoria after a stint in QLD and is looking forward to working with ORM clients across a broad range of areas.