|

The discussion with your bank manager on the topic of interest rates often gets a bad rap when associated with agricultural businesses. A common comment from farmers that we hear is, “They only ring me when something is wrong!” However, this common misconception doesn’t do your banker’s justice. They are in fact an integral cog in your business network and have an important role to play in your farming business and as such should form a key part of your professional adviser team. |

|

Understanding Your Current Interest Rates

|

Ways to Keep the Banker Happy

When farm businesses approach ORM for advice or assistance when reviewing their interest rates, we relay it should never be just about arguing for a lower interest rate because your neighbour has it. You need to be in a position to tell the bank about the strengths of your own business. When talking with your bank or prospective bank you are trying to paint a true, honest representation of how your business is travelling; past, present and future and to understand the three fundamental aspects that all good bankers assess their clients on, the three ‘Cs’: Cashflow, Collateral and Character.

Questions to ask yourself about the three ‘Cs’

| Cashflow: Is your business able to generate a surplus going forward into the next 12 to 24 months while also sustaining an acceptable level of serviceability? Are you meeting your interest cost requirements currently and are you able to repay your debt over a 15 to 25-year period?

Collateral: Does your business have enough security to borrow against? Typically, there is other pre-existing owned farmland within your business, but it can also be other farm assets like a permanent water right and feedlot structures. Most banks will allow borrowing up to 50% equity and if the above ‘Cashflow’ requirement is met they may allow borrowings up to 70% equity. Character: Are you always honest and transparent in your approach with your bank? It is important not to hide important upcoming matters like machinery purchases or land purchases, making sure you keep your bank in the loop regarding major financial matters that will happen within your business. |

|

Negotiating with Your Bank – Tips and Preparation

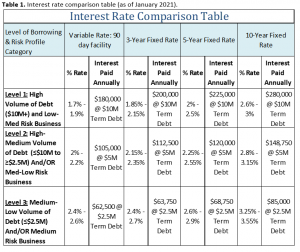

The age old saying ‘Sharpen your Pencil’ comes to mind whenever you are talking with bankers about interest rates. Table 1 will hopefully make it a bit easier to decipher where your interest rate should be, given your current borrowing level and risk profile. (n.b. Table 1 is only our basic guide on the current lending environment and is subject to change on a monthly basis).

|

Get in touch to find out more Contact Us