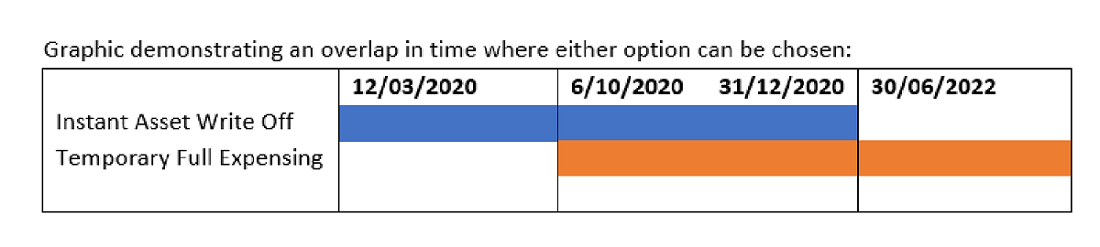

| As COVID-19 and the various restrictions around it continue to bite, the Federal Government have introduced a number of initiatives to stimulate business activity, including new legislation which allows small businesses to write off or fully expense selected assets purchased since 12th March 2020 through to 30th June 2022. Let’s explore what this means for your business? |  |

What is it, and do I qualify?The new legislation is split into 2 different packages:

Another factor to consider for Instant Asset Write-Off is that you must be a small business with a turnover below $500 million, however most farming operations would qualify for this. The Temporary Full Expensing laws are also more generous on this count, as they expand out to $5 billion of aggregated income.

|

Enough of the technical mumbo jumbo, tell me how it is used!

|

An example of how these options might be used is with the purchase of a new header. If purchased on 11th November 2020 for $400,000 this would exceed the maximum permissible expenditure amount under the Instant Asset Write-Off provisions. However, it falls into the date range of the Temporary Full Expensing option, and therefore, the entire purchase price is claimable (fully expensed) in the 20/21 tax year as long as the asset is delivered and ready for use by 30th June 2022. |

What about a new ute?

A new ute can be purchased and claimed for by either option as long as it fits the criteria of either being valued at less than $59,136 or have a carrying capacity of over one tonne. It must also be purchased and delivered by the dates mentioned in the preceding sections.

Are there any downsides to using these provisions?

Firstly, there are a couple of things to be aware of. If the asset purchased is expensed entirely in one year via either the Instant Asset Write-Off or Temporary Full Expensing option, then there will be no trailing depreciation expense to claim over the following several years. This may lead to more tax being paid in those following years. Also, because the asset is being written off in the year of its purchase, any proceeds from the sale of that asset are fully taxable at the time of the sale, without any unclaimed depreciation to offset this.

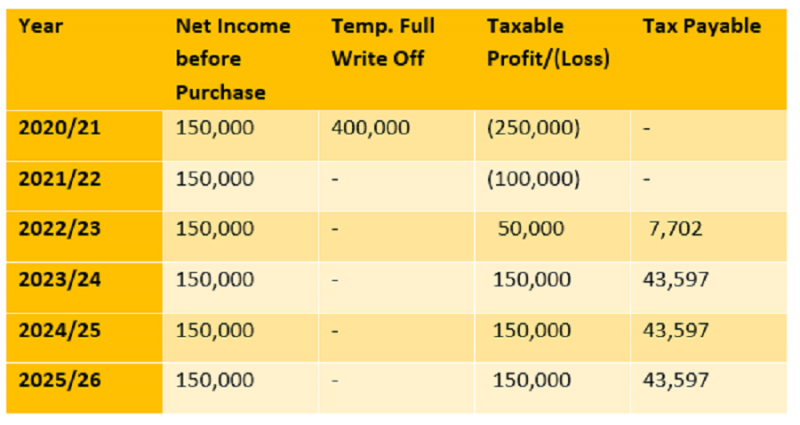

Another consideration might be that the purchase of an asset pushes taxable income into a loss, which may not necessarily reflect the year correctly, as you can see in the below example with the new header:

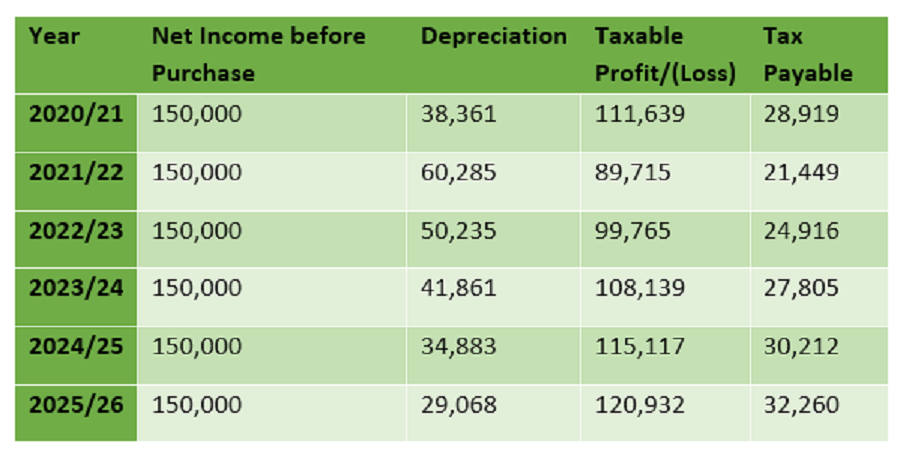

Whereas the income (and tax) is ‘smoothed’ when the traditional depreciation rates are used instead:

That said, in the above scenarios the depreciation method leads to an additional amount of almost $27k being paid over the 6-year period.

A case study…

Jim has had a pretty good year and decides to purchase a seeder for $300,000. He buys it on 1st November 2020, and it is delivered a week later. He gets to the end of the financial year and visits his accountant, where they discuss the seeder purchase and what his options are, including depreciating it over 15 years or claiming it upfront under the Temporary Full Expensing option. The seeder is too expensive to fall under the Instant Write-Off provisions.

| Jim has made a profit before tax (excluding the seeder purchase) of around $320,000 for the year and believes that these types of profits will stay at a similar level for the next few years. So if using depreciation this profit would be reduced by around $40,000, reducing taxable income to $260,000 and resulting in a tax bill of approximately $92,897. If Jim opts for the Temporary Full Expensing option, Jim’s taxable income is reduced to $20,000 with tax payable nil after tax rebates. |  |

Please note that the information provided above is of a general nature and may not apply to your situation. ORM recommends you discuss the Instant Asset Write-Off and Temporary Full Expensing measures with your tax adviser or accountant.

[i] Instant asset write-off | Australian Taxation Office (ato.gov.au)

[ii] Temporary full expensing | Australian Taxation Office (ato.gov.au)

Get in touch to find out more Contact Us