Hopefully our parents will live long, happy, healthy lives, but if they need extra care in their later years how does that work for farming families?

Understanding what costs to expect and how farm assets impact on government benefits can help farming families plan and take some of the stress out of starting the conversation with our loved one.

What is the plan for your farm?Many farming families have a rough succession / retirement / estate strategy in mind, however it works best when plans are verbalised and discussed between generations. A clear understanding of what the older generation want to do allows everyone to plan towards this, and potentially access government benefits such as subsidised aged care home fees. |

|

Some aged care benefits are means-tested, with the assets being assessed including:

- Farm assets that have been transferred to the next generation. These are considered “gifts” and continue to be considered assets of the original owners for the next 5 years after the transfer.

- If one or both are the Appointor of a Family Trust then they are considered to own all assets in the trust.

- Value in superannuation, which may include farm land.

- Value of a couple’s home, although this is capped at around $172k (May-21) and excluded if one of the couple continues to live in their home.

- Any debt should offset asset values.

- Couples are considered to have half of their combined asset value each, regardless of who’s name it is in.

|

Having an external advisor work with you can help ensure everyone’s wishes are considered, ease the discussion around transferring assets and clearly understand the impact on both generations. |

The Cost of Aged Care

Aged care costs vary enormously between homes, depending on where they are and what they provide for residents.

| Aged care fees are broken into various categories (see end of this article for further details). How they are paid will vary, depending on whether the resident has reached means and/or income test thresholds and whether you provide an up-front Accommodation Bond to the home.

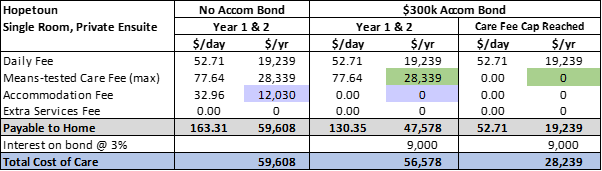

The following example uses the current fee structure for an aged care home in Hopetoun, with the assumption that no government assistance is received. |

|

Notes:

- If no accommodation bond is paid up front, then the annual cost is currently around $60k/yr.

- If the maximum accommodation bond (set by each individual home) is paid, then the interest offsets the accommodation fee and the annual cost is around $48k/yr, and there is a slight reduction in the total cost.

- The means-tested care fee has both an annual and lifetime cap set by the government. The current cap is $28,338.71/ year and $68,012.98/lifetime. Once these caps are reached the individual does not pay any further Care Fees.

- Each home must publish their maximum accommodation costs on the My Aged Care website, however there may be scope to negotiate a lower price with individual homes.

Once you decide which home your loved one will go into you can clarify with the home: their fees, the maximum bond amount and what interest rate they offer on the bond.

Bond, no bond or partial bond?

|

Providing an accommodation bond reduces the daily accommodation fee to be paid, but who will provide the funds for the bond? Does your loved one have superannuation they can withdraw funds from? Does the farm have security available to borrow and fund the bond? What interest rate is offered by the home vs what interest rate would the farm incur on a loan to fund the bond? |

This analysis is best done once a home has been decided on and negotiation on rates has started with the home.

Who pays the remaining fees?

Lastly, you need to consider who will pay the remaining daily fees (Daily, Care, Accommodation, Additional/Extras)?

Some homes have places which are designed for people whose only source of income is the aged pension, in which case the aged pension and government subsidies cover most or all of their costs, and leaves the resident with a small amount of aged pension for personal spending. Other homes will have higher costs that need to be funded by the resident’s superannuation, sale of assets or contributions from their family.

Again, this is best left until you know the costs that will be incurred and your loved one’s assets/income at the time.

Plan Ahead and Discuss Possibilities

It is hard to know if someone will need to go into aged care, but talking to parents about their preferences is a good start, whether as part of a structured succession planning process or around the kitchen table.

This article is designed to provide some background in what to expect in terms of costs. If you would like assistance with reviewing the funding alternatives when aged care is becoming a necessity, please Contact Us to find out more

More Details on Fees

The “My Aged Care” website is a great source of information. A brief summary of aged care home fees is as follows:

Fees set by the government:

- Basic Daily Fee

- Covers day-to-day services such as meals, cleaning, laundry, etc.

- 85% of Single Aged Pension rate.

- Means-Tested Care Fee

- This fee goes towards the cost of your personal and clinical care, eg bathing, dressing, nursing services, medication assistance, etc.

- Rate ranges between $0/day and $256.44/day (in May-21) depending on your asset value.

However, these rates are capped both in terms of $/year and $/person for their lifetime. In May-21 the caps are around $21k/yr and $65k lifetime cap.

Note – government fees are indexed and updated 6 monthly.

Fees set by the individual home:

- Accommodation Fee

- Covers the cost of the room and will be influenced by the location of the home, whether it is a shared or private room and what facilities are available to residents.

- There is some government support to subsides this fee, which is income and means tested.

- Additional / Extra Service Fee(s)

- Each home may have extra fees depending on what is available to residents.

- Additional services may be mandatory or optional, eg paid TV services, onsite hairdresser.

- Extra services may apply to the whole home or particular rooms, eg special menus, better quality linen/room furnishings.