We recently had the pleasure of doing some financial modelling for the GRDC Farm Business Updates in South Australia. This presentation focused on purchasing farmland at current prices and the effect on farm returns.

This has been a hot topic for the last few years in the Australian Grains Industry, as many regions continue to see a phenomenal rise in land values. This newsletter highlights the key outcomes.

What needs to be considered before purchasing?

A potential expansion needs to be viewed through strategic, operational and financial lenses to judge whether it’s a good fit for the business. The lenses should be applied in the above order. If the asset is not a strategic fit or impact the existing operations, then there is no point investigating further. So, what does a good fit look like?

- A good strategy will stop you buying a Blockbuster franchise, even if the financials currently look ok. It might include diversifying enterprises or geographies to manage risk.

- A good fit operationally will allow you to get better utilization out of existing assets and resources. It might also allow your business to accommodate the next generation into a business.

- A good financial analysis will give you the best chance of growing your profitability along with your scale.

Case Study Farm

The sections below are based on a modelled farm from ORM’s database.

Where to start?

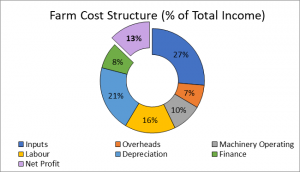

| Begin with a financial analysis of the farm’s own historical data and costs structures to determine the current level of profitability. The chart shows the modelled farm is currently profitable, retaining 13% of total income (as net profit before tax) over the past 5 years. This demonstrates the farm has a financial buffer to absorb shocks, plus the potential to fund an expansion. |

|

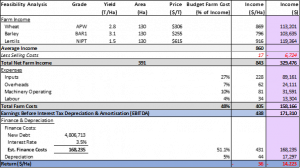

| The next step is to look at the productive capacity of land and the financial fit for the business. The table shows the model farm is looking to purchase 391 hectares, which is 15% of its’ current area. If purchasing at market value for $4,698/acre, then the total acquisition cost will be approximately $4,806,000 (after stamp duty and legal fees.) |  |

We can then use some assumptions to conduct a feasibility analysis on the farmland, including:

- 5-year average yields

- 5-year average commodity prices

- Interest rates

- Current cost structures, allowing for any some labour and machinery efficiencies.

The table below shows the financial performance of the farmland in isolation from the business. This demonstrates a negative return of -$36/hectare, or -$14,220 in total. This would encourage us to either reduce the price we are prepared to pay or look at a different expansion option.

Using current high commodity prices and based on average yields, the asset would generate a positive return, but we need to be conservative with assumptions.

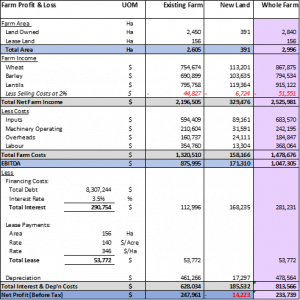

The farmland purchase can then be analysed in combination with the existing farm to calculate a whole farm return. We can see that despite increasing income, the new cost base does erode the farm’s net profit (before tax) by $14,223. This is the equivalent to:

- Reducing net profit by $17/ha or,

- Reducing overall profitability by 5.7%.

This is happening due to the increased interest expense; the expansion is 100% debt funded. Despite increasing the income, interest costs have increased from $64/ha to $112/ha, or by 5.7% of total income.

Equity & Security

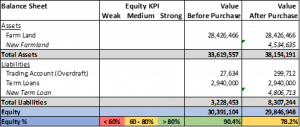

|

By purchasing another 391ha, our model farm goes from 90% to 78% equity, in the medium to strong zone. From a security perspective, lenders would likely be comfortable with the expansion.

|

How sensitive is profitability to our largest expenses?

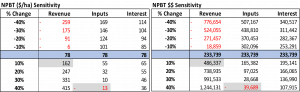

It is also important to conduct a sensitivity analysis, particularly in the current volatile commodity price and cost environment. This will allow us to identify our biggest risks and to look at mitigation strategies.

We can see that changes to prices received for our commodities, yield or a combination of both have the biggest impact on profitability. For example:

- With a 10% increase in revenue and no increase in expenses, the NPBT more than doubles to $162/ha or $486,337

- The next biggest driver of profitability is input costs; an isolated 40% increase in inputs would make the business unprofitable at -$13/ha or -$39,689

- Interest expense is always important to consider as it can be one of the easiest expense items to control.

Where to from here?

Taking the time to sit down and step through the strategic, operational, and financial can be of real benefit for a farm looking to expand. A thorough analysis can:

- Give the business owner more confidence in the decision to increase scale

- Provide lenders and stakeholders more comfort and assist them with any loan application

- Highlight current areas for improvement, regardless of whether you are successful with the expansion opportunity or not.

ORM can provide financial modelling and advisory for different farm expansion opportunities to help grow your business. For more details, please contact us here admin@orm.com.au

Ben Hogan, Agribusiness Consultant

Sam Bruce, Business Consultant