When committing to buying or upgrading a truck, growers should consider the initial capital invested in the truck versus the revenue earned and the labour requirement for operating the truck.

| ORM farm data and benchmarks indicate that for a consolidated grain farm in the Wimmera-Mallee, total value of plant and machinery should approximate the gross annual income for a business averaged over a 5-year period. Another ORM 5-year benchmark, derived from actual farm data, shows that growers should be investing 10-12% of gross income each year on machinery capital purchases. ORM recommends that growers consider these benchmarks carefully when making major capital purchases such as buying a truck. |  |

When buying or upgrading a truck growers need to consider factors such as what type of truck they wish to purchase, the capital cost, the purpose of owning the truck and its utilisation, the tonnes and distance travelled per year and the cost of labour in operating the truck.

|

The truck can generate extra farm income as freight. This income can cover additional labour on-farm. The freight income is often built into the delivered price hence not clearly identified in the cashbook, so some estimates of truck revenue are needed when assessing the trucks economic return. |

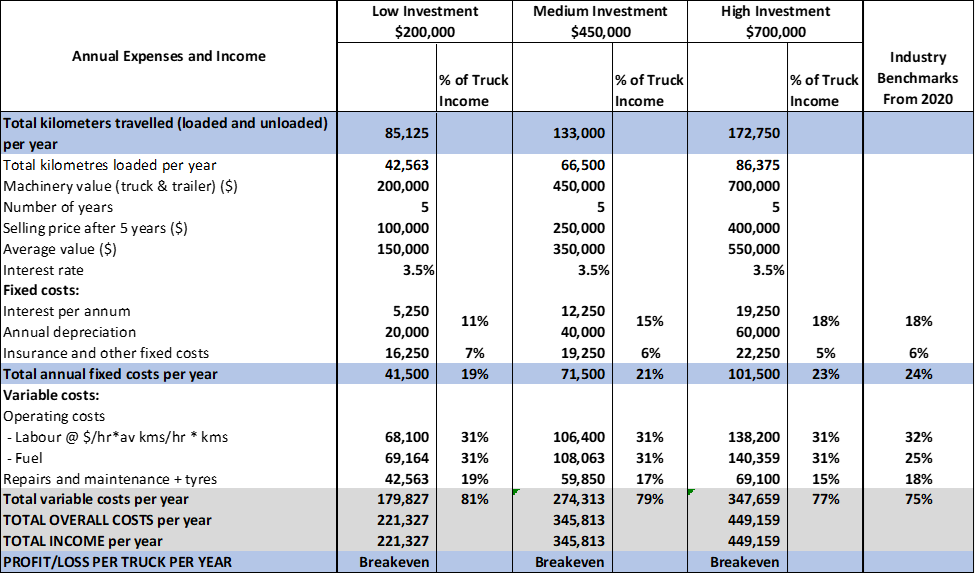

The table below illustrates the type of analysis required before buying a truck. The table compares three different levels of investment in trucks: $200,000, $450,000 and $700,000. The $200,000 investment represents a second-hand truck and trailer whereas the $700,000 investment represents a new truck and trailers. The analysis assumes the truck and trailers are financed at 3.5% over 5 years and are sold after 5 years. The annual depreciation rate is calculated as the purchase price less the selling price divided by the 5-year investment period. It is assumed that the charge-out rates are $5.20 per kilometre.

Table 1. Comparing different levels of capital investment at the point of breakdown

Assumptions:

Truck load = 44t

The per kilometre rate = $5.20/km

| If purchasing a second hand $200,000 truck and trailer combination, the total kilometres travelled to get the breakeven point is 42,563km of loaded kilometres. If we assume 44 tonnes per load and 300km to the port this equates to 6,242 tonnes.

If the farm purchases a $450,000 truck and trailer combination, the truck needs to travel 133,000kms, or 66,500km of loaded kilometres, to breakeven. If the farm intends the truck for own use, then 9,750 tonnes covers costs, i.e., is the breakeven tonnage. |

|

If the farm purchases a new truck and trailer combination for $700,000, the truck will need to travel 172,750km, or 86,375km loaded kilometres. If the farm wants the truck to ‘pay for itself’ i.e., breakeven the 86,375km of loaded kilometres is equivalent to transporting 12,700t at average 300 loaded kilometres. If this is more than the farm produces, then the farm might consider backloads and some commercial work to help cover costs. Labour is another issue when considering this high value new truck. If it is assumed that a round trip to the port is 600km, and the truck works 5 days a week at 1 load per day then 156,000km is travelled in a year (52 weeks), however for the truck to breakeven it needs to travel 172,750km! These extra kilometres can be covered by the backloads or may require an extra driver in two shifts to cover the extra 16,750km for a 6-week period! Another consideration is the downtime for servicing, new wheels, breakdowns etc.

The extra labour required for the two higher investment options for the trucks to reach breakeven is a consideration, especially when the truckdriver is needed on farm over the peak seasonal times. Another consideration is the question of whether the higher investment trucks lead to over-capitalisation on the farm, as ORM suggests, for a consolidated grain farm in the Wimmera-Mallee the total value of plant and machinery should approximate the gross annual income for a business averaged over a 5-year period. For example, for a 4,000ha farm with average crop yields the average gross income is approximately $2.4 million, therefore the total value of plant and machinery, including header, seeder, tractor, sprayer, bins etc. should be around $2.4 million.

|

Matching capital investment to farm scale is the key. A farm intending to shift 6,000 tonne of grain and average 300 loaded kilometres per load, and do 300 tonnes of backloads can breakeven with an investment of around $300,000. |

There are many non-financial advantages to owning a truck when operating a farming business, including the flexibility in delivering commodities like wheat to end user customers, picking up your own fertilisers from port, improving harvest logistics or for more effective utilisation of labour in off-peak times of the year.

If you’d like to check your machinery investment guidelines contact ORM for assistance on how to calculate these.

Contact ORM for more information – Contact Us